Regen Proposes Domestic Carbon Levy

Regen notes the distortion in the market in favour of burning gas for heating and proposes a domestic carbon levy to get the UK on track to achieve Net Zero carbon emissions. We recommend you read the full Decarbonisation of Heat paper. For those short of time we include an extract and the key graphic below:

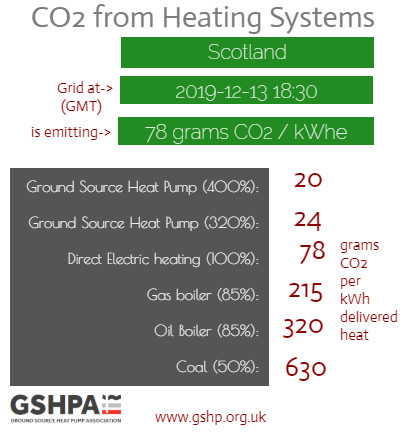

A significant element of your household energy bill goes to meet the environmental and social obligation levies.1 However, in our current system, the levy makes up around 20% of the average domestic electricity bill, but only 1.6 % 2 of the average domestic gas bill. Given that, on average, grid electricity now results in a similar carbon impact to gas for every kWh consumed 3, this creates a significant price distortion that is dissuading consumers from switching to lower carbon electricity for heating and cooking, or to adopting energy efficiency measures.

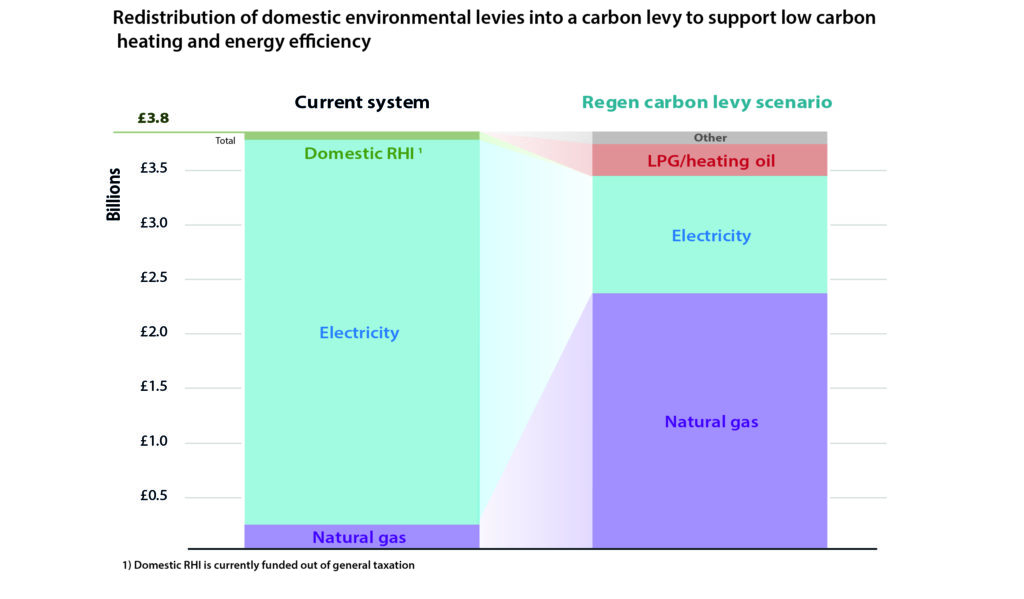

Our recent Decarbonisation of Heat paper recommends that these environmental levies and the domestic RHI (worth £3.8bn per year) should be reconfigured into a new domestic carbon levy. This redistribution would remove the fuel price distortion that favours fossil fuels and give a much stronger price signal in favour of low carbon solutions and energy efficiency.

Many economists and policy makers now agree that the use of carbon pricing will be an important policy lever alongside regulations and other support mechanisms for low carbon technologies. This point was also highlighted in the new Chancellor's March 2020 budget announcement during which he noted that "Electricity is now a cleaner energy than gas" but our Climate Change Levy, paid by companies, taxes electricity at a higher rate. So as another step towards equalising the rates and encouraging energy efficiency, from April 2022 I'm freezing the levy on electricity and raising it on gas.4

The Chancellor's policy change only focuses on a small part of the overall environmental levy and offers a freeze not a redesign. A broader domestic carbon levy proposed by Regen, even if revenue neutral, could see a £36 per tonne cost of CO2e applied across all fuels which would decrease electricity unit costs by approximately 14%, and increase gas unit costs by 16% per kWh, based on current prices and existing levies.

The impact for the average energy consumer would be negligible, but there would be a very positive incentive to reduce household carbon emissions through efficiency measures and the adoption of low carbon technologies. Those using electricity for heating, who are twice as likely to be in fuel poverty, would see an energy bill decrease, while those using fossil fuels would see a bill increase for their gas (and a bill decrease for their electricity).

3 https://www.gov.uk/government/collections/government-conversion-factors-for-company-reporting

4 https://www.gov.uk/government/speeches/budget-speech-2020

The high "environmental levy" on UK electricity prevents the decarbonisation of heat

A key reason to install a ground source heat pumps is that one kilowatt of electricity can be used to transfer 4 kilowatts of heat into your building. This high coefficient of performance of 4 is sadly neutralised by the taxes and levies on electricity that artificially raise the price of electricity to be 4 times the price of gas in the UK.

It is the high price of electricity in the UK that is preventing the decarbonisation of heat that is so urgently needed.

See Renewable Heating See Renewable Cooling